Credit Cards

Just one more benefit of membership.

Cash Back or Rewards. Personal or Business. The choices are yours.

Smart Financial credit cards earn you cash back or rewards, or both, depending on the card you choose. You must be a Smart Financial member to apply for our credit cards. Click here to learn how to apply for a Smart Financial credit card.

Not a member yet? Learn how you can join the Smart Financial family.

Log into Card Assets to pay your credit card balances, view transaction history, set up alerts and manage your rewards.

Personal Credit Cards

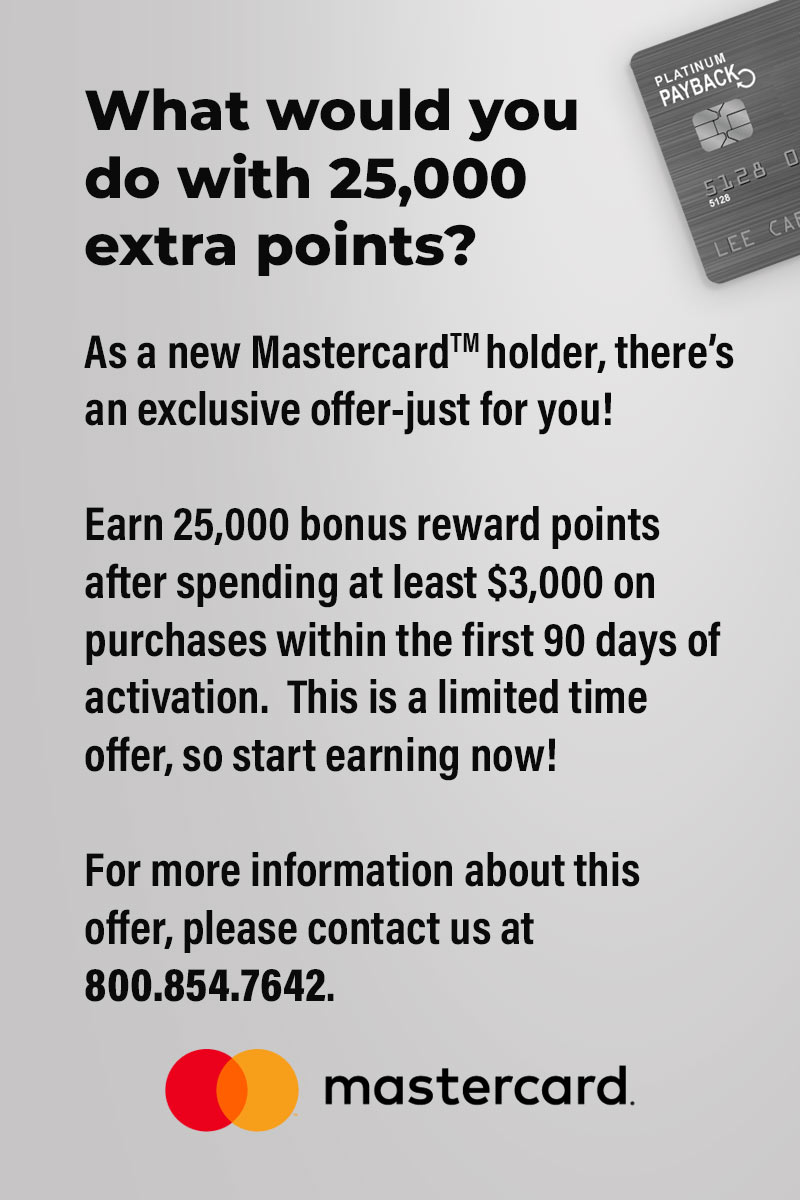

Platinum Payback Mastercard®

• 1% cash back as you spend

• No annual fee

• Mastercard ID Theft Protection™

World Mastercard®

• 1% cash back or Everywhere Rewards* points ($1 = 1 point)

• $35 annual fee

• Mastercard ID Theft Protection™

• Mastercard Travel & Lifestyle Services

• Priceless Cities Offers & Experiences

• Door Dash, Hello Fresh, & Lyft credits

Business Credit Cards

Business Platinum Payback Mastercard®

• 1% cash back as you spend

• No annual fee

• Mastercard ID Theft Protection™

Business World Elite Mastercard®

• 1% cash back or Everywhere Rewards* points ($1 = 1 point)

• $29 annual fee

• Intuit Quickbooks® discounts